Is it me, or are turnkey rental properties just like olives?

I mean seriously, folks. You either love them or hate them. Am I right? You know what I’m talking about!

There are many mixed emotions regarding turnkeys, and people aren’t afraid to express how they feel about them. It’s true, they may not be the right fit for a lot of investors, and it’s also true that may just be the perfect fit for other investors. At the end of the day, it really all comes down to what is best for you and your family, and of course whether or not they are going to make you some cash flow! Cash flow is the name of the game here, and there are no other reasons you should be investing in turnkey properties if cash flow is not your #1 priority.

I decided a few years ago after continually being outbid in my local market for cash flowing properties that it was time to shift gears and start investing elsewhere. This was not an easy decision by any means, and it took me countless hours of research and sleepless nights before I ever pulled the trigger on my first out-of-state turnkey property.

I’m happy to say that as of right now, I am in the process of purchasing my fourth turnkey rental property. I have been successful so far with purchasing these in part because I have a very strict criteria for who I will buy from as well as what property I will buy. There are many bad turnkey sellers out there and even more bad turnkey properties. How to avoid a bad turnkey seller merits its own post, which I will write about in the future, so stay tuned.

In today’s post I will show you the actual numbers on the three turnkey rental properties that I have bought so far. I know you love seeing real numbers, and this is why I am going to show you the good stuff.

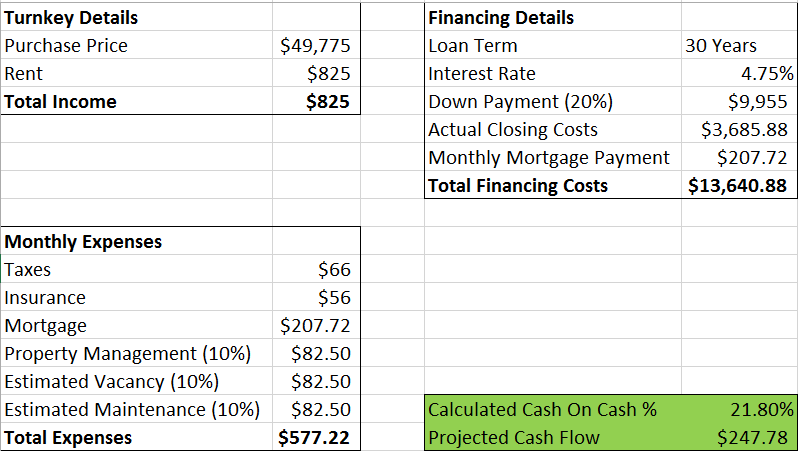

Turnkey #1

Location: Indianapolis, IN (Irvington)

Purchase Date: November 2014

As of today, rent has been paid on time in full every month, and I have paid a total of $162 in various expenses, including leak repair, loose cable repair, and a landlord registration fee. So far this turnkey property is performing well, and I am very happy with it.

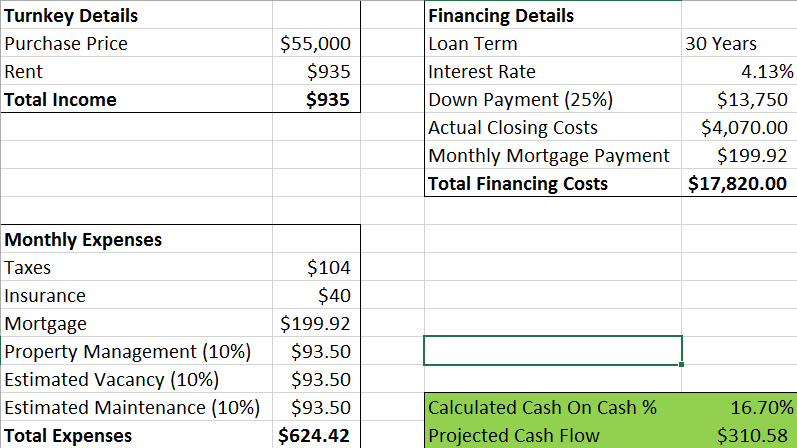

Turnkey #2

Location: Indianapolis, IN (Lawrence Township suburb)

Purchase Date: April 2015

As of today, rent has been paid in full and on time every month. We have had one unexpected plumbing issue, which cost me $230 to repair. This turnkey is only 7 months old, and although the plumbing issue was not expected, the property is still performing as calculated, and I am happy with this investment.

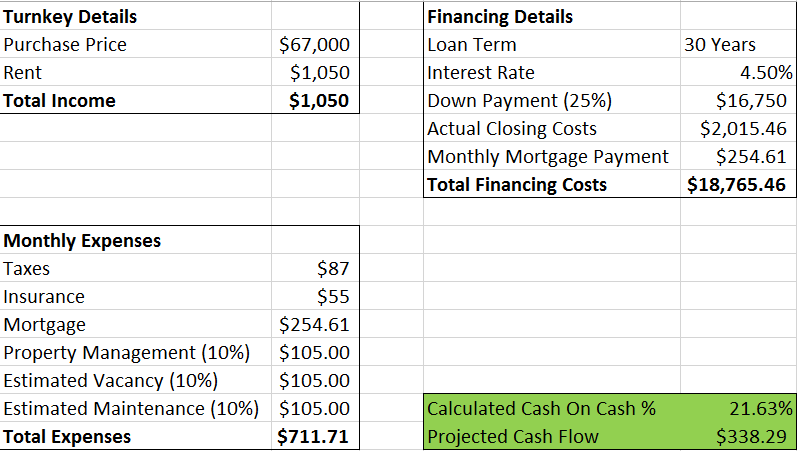

Turnkey #3

Location: Indianapolis, IN (Bates Hendricks)

Purchase Date: May 2015

This turnkey is my newest one (not counting the one I am purchasing right now), and as of today, the rent has been paid on time and in full since day one. There have been zero repairs or issues.

Additional Info

Dates Purchased

As you can see the dates above, none of these turnkey properties are more then a year old, and you will never really be able to accurately gauge how they perform without long term data. As of now, all my turnkeys are performing as I originally calculated, and I am extremely happy with all of them.

Financing

All the properties above were purchased with 30-year conventional loans. The very first turnkey was purchased with a 20% down payment, while the others were purchased with a 25% down payment. This is due to a requirement that mandates you put down a minimum of 25% down payments on mortgages 5-10. I am now on my 6th mortgage and working on my 7th. It is very difficult to find a lender that is willing to give you up to 10 conventional loans at those kinds of rates and under $50k. They are a rare breed, but they are out there.

Purchase Price

All of these turnkey properties are within the $49k-67k purchase price. These are very affordable houses, and it is a very common assumption that houses within these price ranges fall in high crime areas. This of course varies per market, and it is extremely important you properly research any house you buy as well as the locale.

Because of my strict criteria, I have ensured that none of the properties above are in high crime areas, and all of them have had full rehabs. Finding properties with those kinds of returns with brand new rehabs in decent areas is not easy, trust me. I literally sifted through hundreds of properties and dealt with close to a dozen turnkey providers just to get the three above. Many of the turnkey providers out there sell junk, and it’s important to stay away from those guys if you want to be successful with purchasing turnkey rental properties.

Estimated Repairs/Maintenance

Same deal for this one: Turnkey companies will most likely give you a low 5% rate of maintenance. It is important you bump this number up to accommodate for unexpected issues and to make it a more realistic estimate for the long run. I like to use a minimum of 10% on all my properties.

If you decide to purchase a turnkey rental property, it is very important that you proceed with caution and do as much due diligence as you can on your seller and on the property in question. If you do not do this, then you are increasing your chances of failure — and nobody wants that.

Investors: What has your experience with turnkey rentals been?

Leave a Reply